How to Think About Risk in Retirement – WSJ.

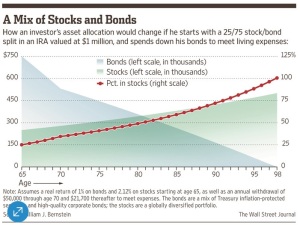

New perspective that challenges the “aged” based ratio when determining a portfolio allocation between stocks and bonds. They suggest spending down the bond portion of a portfolio, which automatically increases the percentage of stocks held. Over the many years of retirement the stock portion is anticipated to continue to grow in value, resulting in a “safety net” of equity at the end of the retirement period.

An excellent analysis and a great article.

0 Comments